If you’re a professional gardener in the UK — whether you’re maintaining large estates or building a tropical planting business — one of the biggest decisions you’ll make is whether to operate as a sole trader or form a limited company.

Both structures are common in the gardening trade. The right choice depends on your profit level, growth plans, and appetite for administration.

Below is a clear breakdown of the tax advantages and disadvantages of each.

1. Sole Trader Gardener

Most gardeners begin as sole traders. It’s simple, flexible, and ideal for smaller operations.

How You’re Taxed

As a sole trader, you:

- Pay Income Tax on profits

- Pay Class 2 and Class 4 National Insurance

- Submit a Self Assessment tax return via HM Revenue & Customs

Your business profits are your personal income.

Tax Advantages of Being a Sole Trader

✅ 1. Simplicity

- No corporation tax returns

- No company accounts filing at Companies House

- Lower accounting costs

For many gardeners earning under £40,000–£50,000 profit, simplicity is a major advantage.

✅ 2. Straightforward Use of Losses

If you make a loss (for example, investing heavily in new equipment or a van), you can offset that loss against other personal income in some circumstances.

✅ 3. Easier Access to Money

All profits belong to you.

No dividend paperwork.

No director salary planning.

You simply transfer money from your business account to yourself.

Tax Disadvantages of Being a Sole Trader

❌ 1. Higher Tax at Higher Profits

Once profits rise, Income Tax becomes expensive:

- 20% basic rate

- 40% higher rate

- 45% additional rate

Plus National Insurance on top.

At higher profit levels (typically £50k+), tax becomes noticeably heavier than a limited company structure.

❌ 2. No Tax Planning Flexibility

You cannot split income with a spouse unless they are genuinely working in the business and paid properly.

2. Limited Company Gardener

A limited company is a separate legal entity registered at Companies House.

You become:

- Director

- Shareholder

The company pays tax on profits, not you personally.

How You’re Taxed

The company pays:

- Corporation Tax (currently up to 25%, depending on profit level)

You then extract money via:

- Salary (PAYE)

- Dividends

Corporation tax is paid to HM Revenue & Customs.

Tax Advantages of a Limited Company

✅ 1. Lower Overall Tax at Higher Profits

This is the main advantage.

Instead of paying:

- 40% Income Tax

- Plus National Insurance

You may pay:

- Corporation Tax (up to 25%)

- Then lower dividend tax rates

For many gardeners earning £50k–£100k+ profit, a limited company can be more tax efficient.

✅ 2. Dividend Tax Efficiency

Dividends are taxed at lower rates than salary and are not subject to National Insurance.

This can significantly reduce overall tax.

✅ 3. Income Splitting

If your spouse is a shareholder, dividends can be distributed to both of you.

This can:

- Use both personal allowances

- Use both basic rate bands

- Reduce overall family tax

Very powerful for family-run gardening businesses.

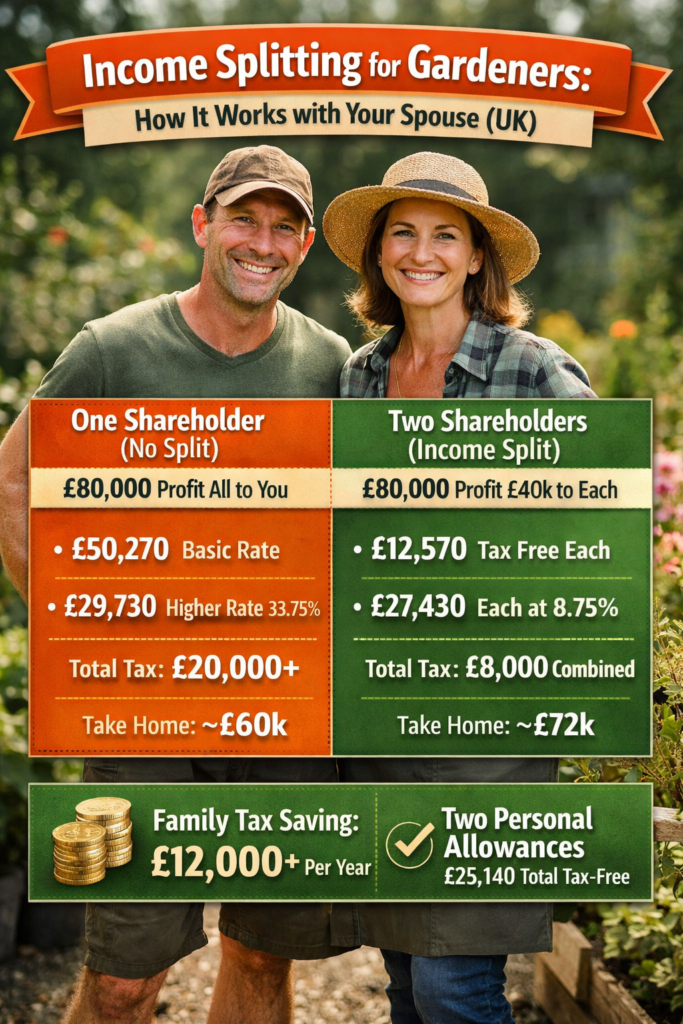

Income Splitting Explained (With Current Personal Allowance Figures)

One of the strongest tax advantages of running your professional gardening business as a limited company is the ability to split income between spouses or civil partners.

Here’s how it works with real figures.

Current Key Allowances (UK)

Under rules set by HM Revenue & Customs:

- Personal Allowance: £12,570 (tax free)

- Basic rate band: 20% on income up to £50,270

- Higher rate: 40% above £50,270

- Dividend allowance: £500 (tax free dividend income)

- Dividend tax rates:

- 8.75% (basic rate)

- 33.75% (higher rate)

(Assuming no other income.)

Example: Gardening Company Making £80,000 Profit

Scenario 1 – One Shareholder (No Income Splitting)

If you extract most of that profit yourself:

- £12,570 tax free

- Income up to £50,270 taxed at basic rate

- Remaining dividends taxed at higher-rate dividend tax (33.75%)

A significant portion of income falls into higher-rate tax.

Scenario 2 – Two Shareholders (Income Splitting)

You and your spouse both own 50% of the shares.

Company pays dividends:

- £40,000 to you

- £40,000 to your spouse

Each person receives:

- £12,570 Personal Allowance

- £500 Dividend Allowance

- Majority taxed at 8.75% dividend rate (basic band)

Now:

- Neither of you crosses £50,270

- Higher-rate tax may be completely avoided

💰 The total household tax bill can reduce by several thousand pounds annually compared to one person receiving £80,000.

Why This Is Powerful for Professional Gardeners

If you are:

- Running estate contracts

- Employing staff

- Generating £60k–£100k+ profit

- Building a family-run gardening firm

Income splitting allows you to use two Personal Allowances (£25,140 total) instead of one.

That alone can make incorporation worthwhile once profits move beyond the basic rate threshold.

Important Notes

- Shares must genuinely belong to both spouses.

- Dividends must follow share percentages.

- Proper records and dividend minutes must be maintained.

- Artificial arrangements can be challenged by HM Revenue & Customs.

Why Sole Traders Cannot Do This

As a sole trader:

- All profit is legally yours.

- You cannot divide profits for tax purposes.

- You may pay a wage to a spouse for genuine work — but this triggers PAYE and National Insurance and does not offer the same flexibility as dividends.

For many established professional gardeners earning above £60,000 consistently, income splitting is one of the clearest financial advantages of moving to a limited company structure.

✅ 4. Pension Contributions

A limited company can make employer pension contributions for you.

These:

- Reduce Corporation Tax

- Avoid National Insurance

- Are very tax efficient

✅ 5. Professional Image

While not strictly tax-related, some estate clients and commercial contracts prefer dealing with a limited company.

Tax Disadvantages of a Limited Company

❌ 1. More Administration

You must:

- File annual accounts

- Submit a Corporation Tax return

- Run payroll

- Maintain dividend paperwork

Accountancy costs are higher.

❌ 2. Less Flexible Access to Money

Company money is not your money until:

- Paid as salary

- Issued as dividends

You cannot just “take cash” informally.

❌ 3. IR35 Considerations (If Contracting)

If working through contracts for one organisation, IR35 rules may apply — although most gardening businesses are unaffected.

Simple Comparison for Gardeners

| Situation | Usually Better Structure |

|---|---|

| Part-time gardener | Sole trader |

| Profit under £40k | Sole trader |

| Profit £50k–£70k | Depends – review |

| Profit £70k+ | Often limited company |

| Employing staff | Often limited company |

| Building large estate/commercial contracts | Often limited company |

Real-World Gardening Example

A gardener earning:

£35,000 profit

→ Sole trader often simplest and efficient.

£80,000 profit

→ Limited company often saves several thousand pounds per year in tax.

The higher the profit, the more attractive incorporation becomes.

The Hidden Factor: Risk

Although this article focuses on tax, remember:

- Sole trader = personally liable

- Limited company = limited liability

If you run:

- Large contracts

- Expensive machinery

- Multiple employees

Liability protection can be as important as tax savings.

Final Thoughts

For most traditional gardeners:

- Start as a sole trader

- Incorporate once profits consistently exceed ~£50,000–£60,000

The tipping point is usually when higher-rate Income Tax starts biting hard.

If you’re building a serious gardening brand — estates, tropical installations, commercial grounds maintenance — a limited company often makes sense long term.

Disclaimer: The information provided on this website is for general guidance only and is based on UK tax rules and professional gardening practices as of the time of publication. It is not a substitute for professional advice. Always consult a qualified accountant, tax advisor, or legal professional before making decisions regarding your business structure, taxes, or financial planning. Local regulations may vary, and results can differ depending on individual circumstances.